Ireland Strategic Investment Fund

The Ireland Strategic Investment Fund, managed and controlled by the National Treasury Management Agency (NTMA), is a sovereign development fund with a unique mandate. Our mandate is to invest on a commercial basis to support economic activity and employment in Ireland. Its predecessor was the National Pensions Reserve Fund (NPRF). The Fund is a strategic investor with strong connections in both the public and private sectors. The Fund is uniquely positioned to make connections and drive innovation across multiple industry players developing and delivering innovative opportunities that might otherwise go unrealised. The ISIF is comprised of the Discretionary Portfolio and the Directed Portfolio. The Directed Portfolio continues to be held within ISIF under direction from the Minister for Finance.

The Discretionary Portfolio has a “double bottom line” mandate to invest on a commercial basis in a manner designed to support economic activity and employment in Ireland. ISIF prioritises the use of its capital and resources to address strategic challenges. ISIF focusses its efforts on making transformational investments across its impact themes of Climate, Housing and Enabling Investments, Scaling Indigenous Businesses, and Food and Agriculture. In addition, ISIF has flexibility to invest in National and Compelling investments in response to future macro events.

Impact Themes

ISIF will prioritise the use of its capital and resources to address strategic challenges and focus its efforts on making transformational investments across its impact themes of Climate, Housing and Enabling Investments, Scaling Indigenous Businesses, and Food and Agriculture.

The ISIF portfolio is diversified across many regions and sectors of the Irish economy.

Find out more

Meet the team

The activities of the ISIF is supported by a diverse workforce. At the NTMA, we believe that delivering long-term value to the State requires a culture where inclusion and diversity are embedded in our processes, behaviours, and values. We recognise that a diverse and inclusive workplace informs better decision making, creative thinking, innovation and drives business performance.

Meet our teamISIF Investments

The ISIF portfolio of investments is diversified across Ireland and many sectors of the economy.

ISIF PortfolioNTMA

The National Treasury Management Agency (NTMA) is a State body which operates with a commercial remit to provide asset and liability management services to the Irish Government. It controls and manages the Ireland Strategic Investment Fund (ISIF).

ISIF Governance

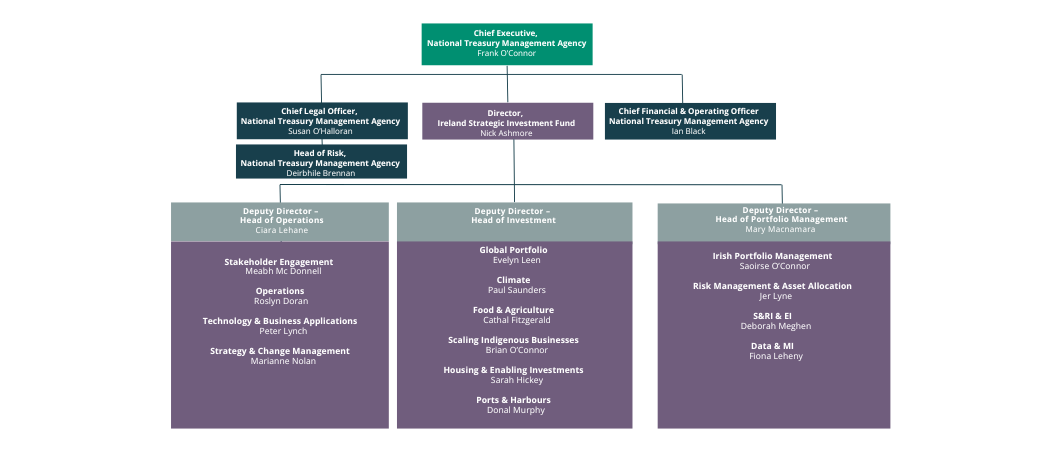

The NTMA is the controller and manager of the Ireland Strategic Investment Fund. The NTMA is led by the Agency (Board), which has over-arching responsibility for all of the NTMA's functions including the management and investment of the Ireland Strategic Investment Fund. The Agency is accountable to the Minister for Finance. The NTMA is led by the Chief Executive who reports directly to the Agency Board. Directors of each NTMA business unit support the Chief Executive of the NTMA. The Ireland Strategic Investment Fund director reports to the Chief Executive and is supported by three Deputy Directors.

The Agency established the Investment Committee to assist it in discharging its responsibilities for the Ireland Strategic Investment Fund. The Investment Committee makes decisions about the acquisition and disposal of assets of the Ireland Strategic Investment Fund within such parameters as may be set by the Agency, advises the Agency on the investment strategy for the Fund and oversees the implementation of the investment strategy.