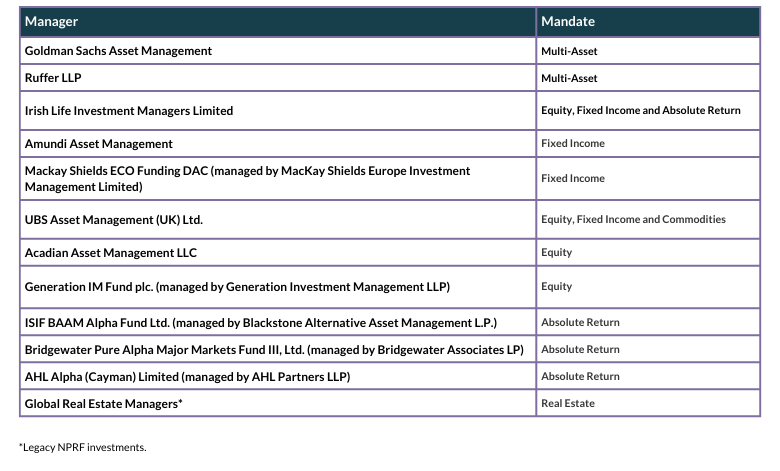

Global Portfolio

There are €5.2bn of assets globally invested of which just over €1.5bn are reserved for other Government priority initiatives (€1.15bn to Land Development Agency (LDA) and €0.4bn to Home Building Finance Ireland (HBFI)). The main objective of the global investments is to provide liquidity for Irish Portfolio investments as well as other directed or expected withdrawals (including in respect of HBFI and the LDA) and to earn an appropriate risk adjusted return that will assist ISIF’s performance with a low-risk appetite.